70以上 yield curve 2021 496115-Inverted yield curve 2021

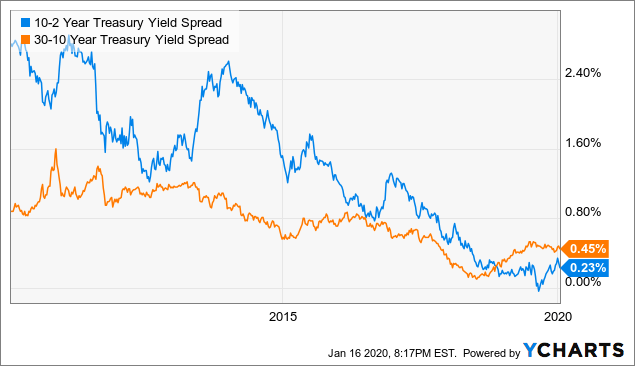

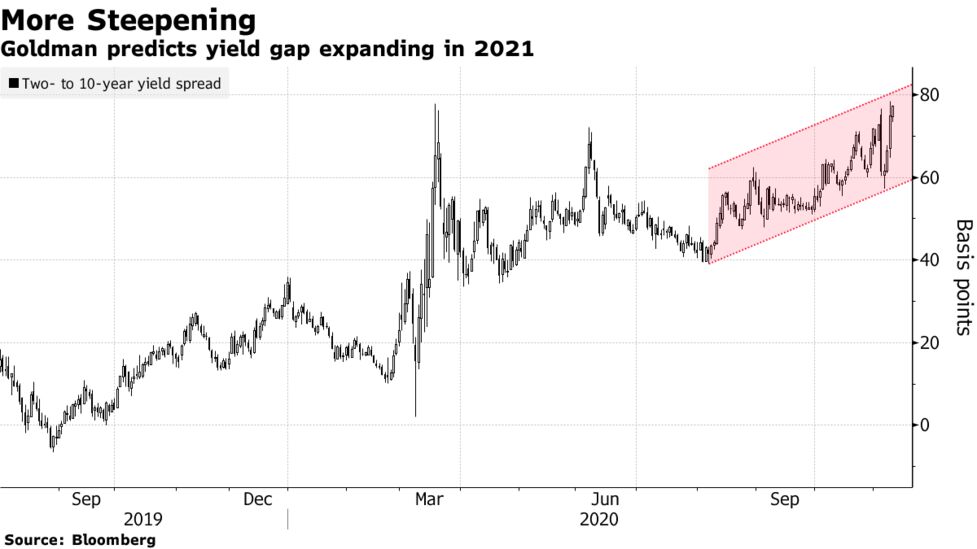

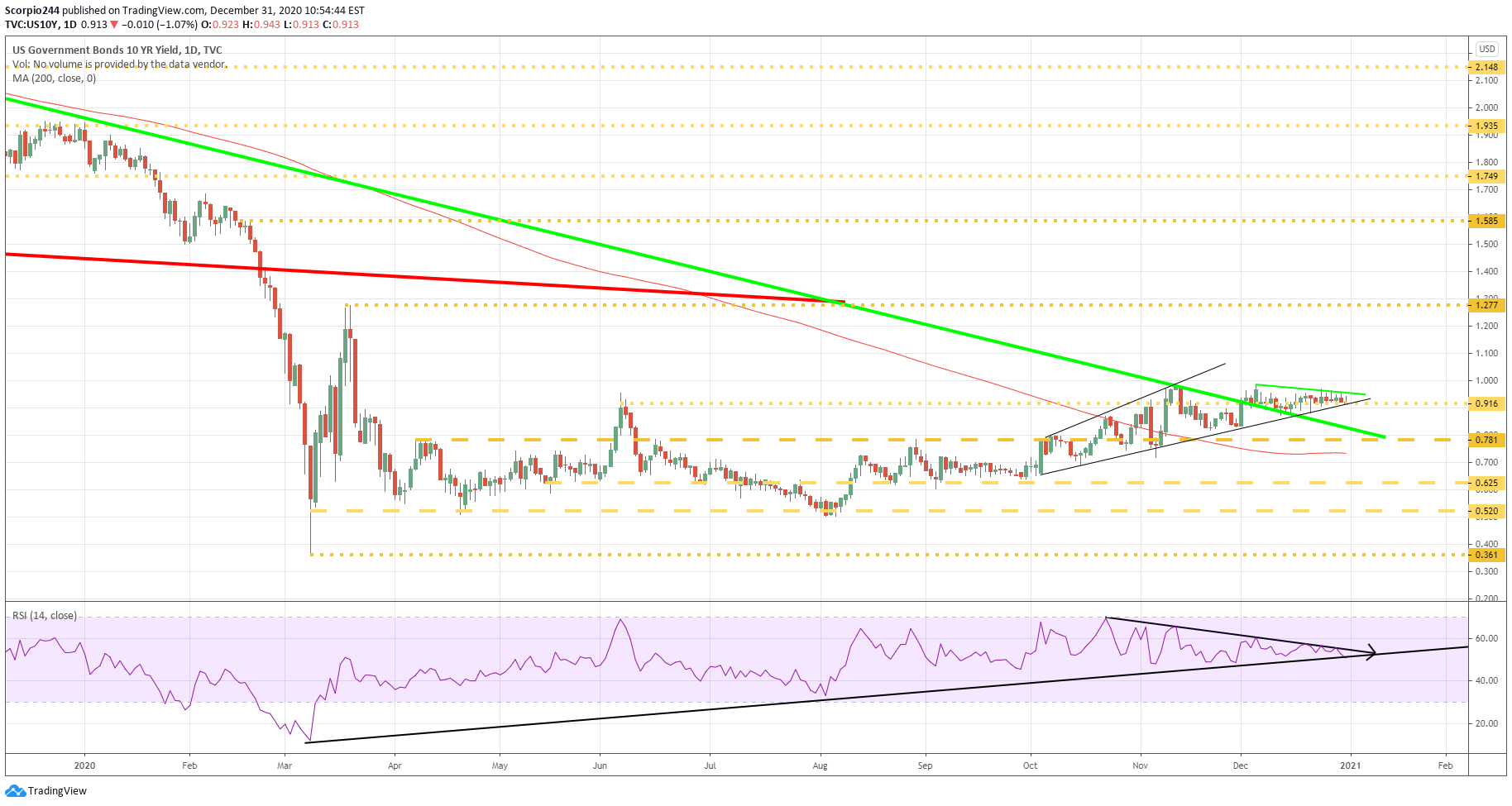

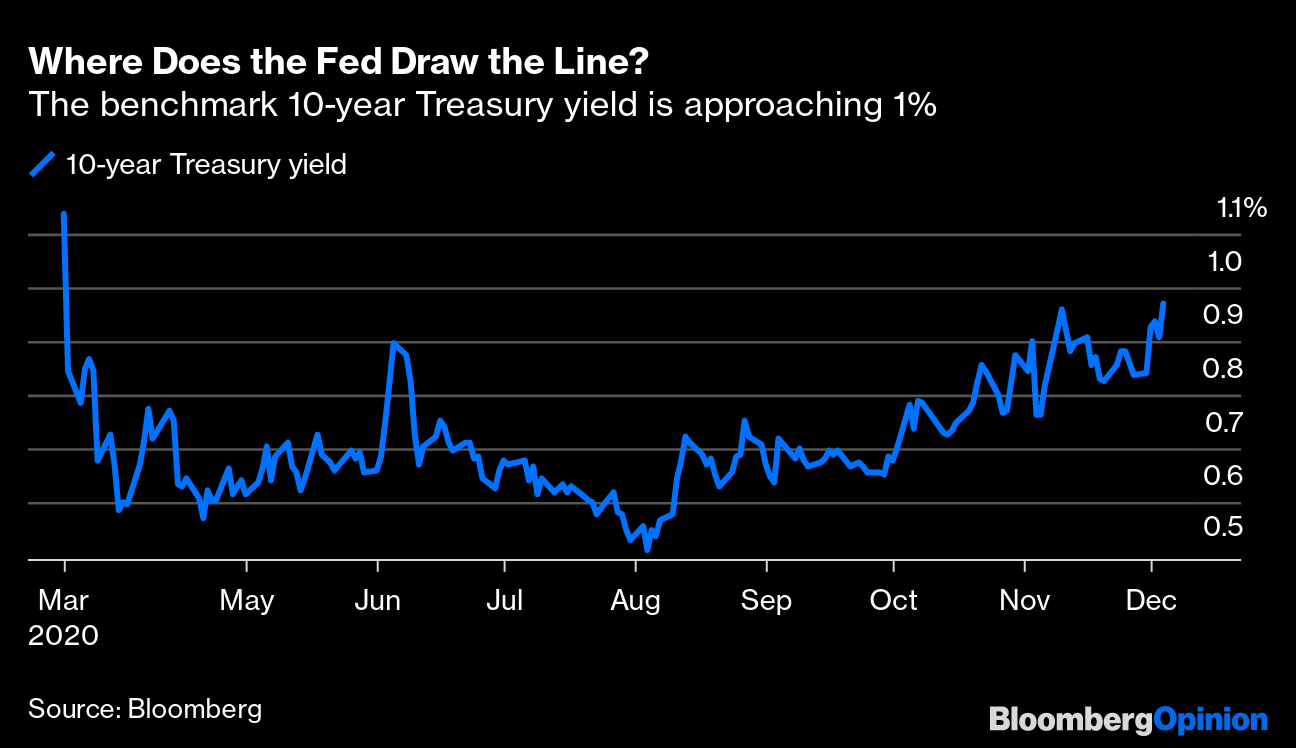

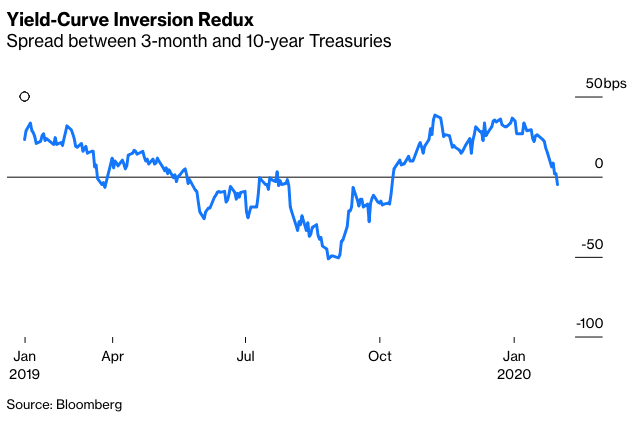

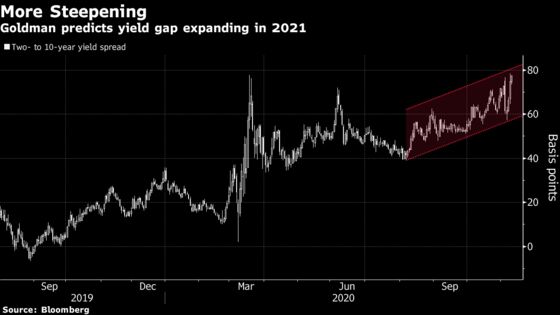

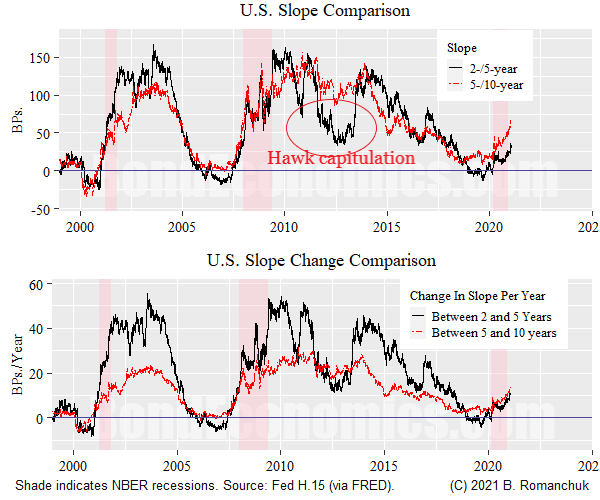

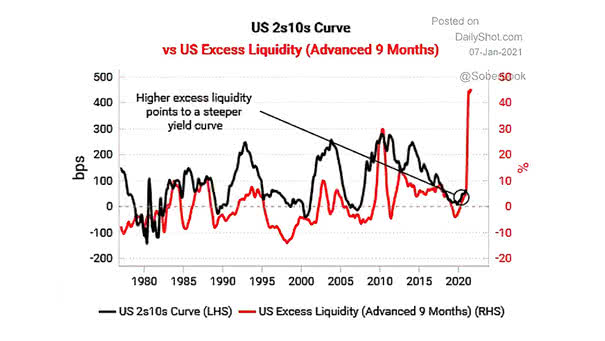

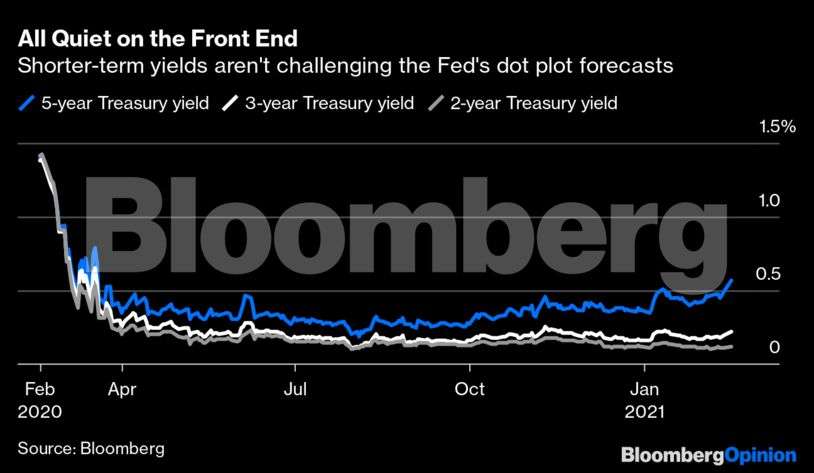

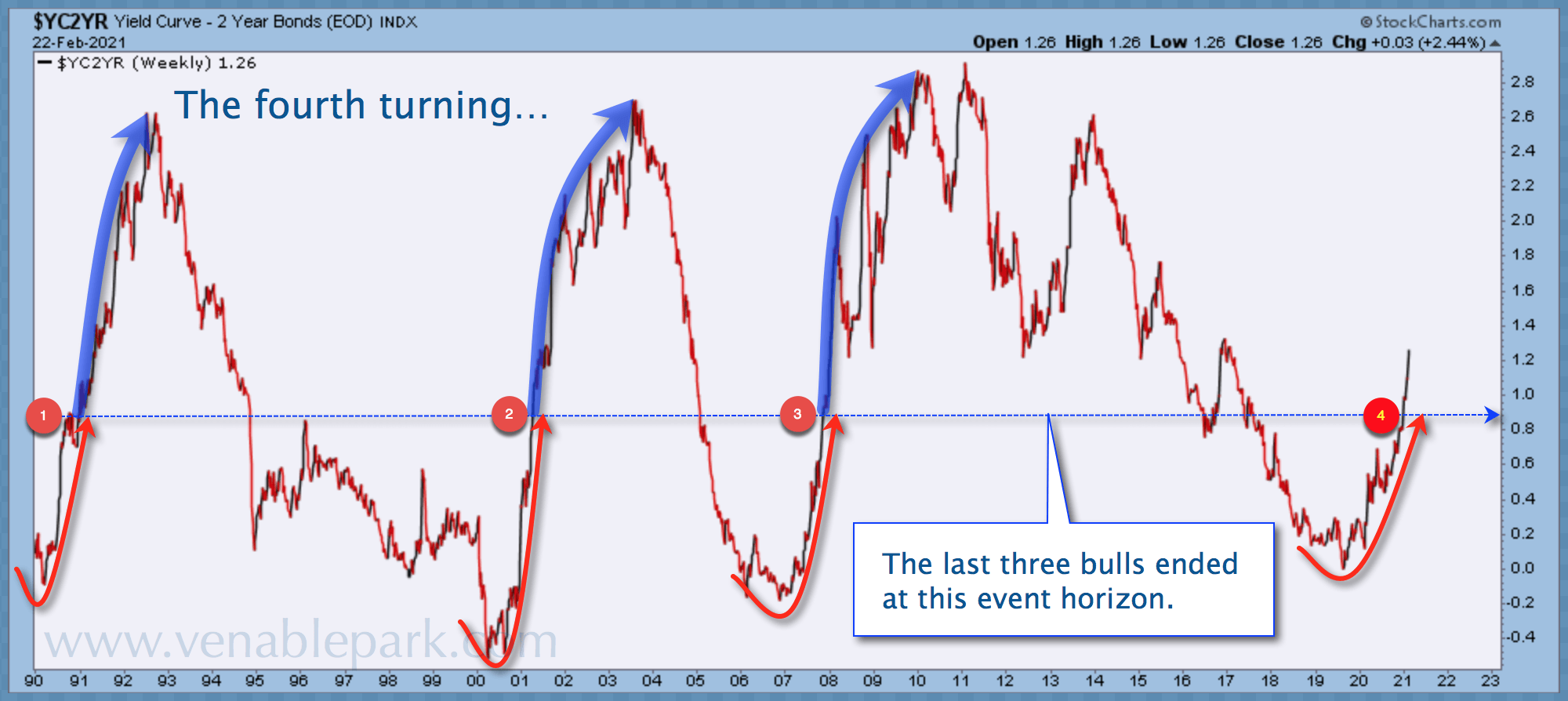

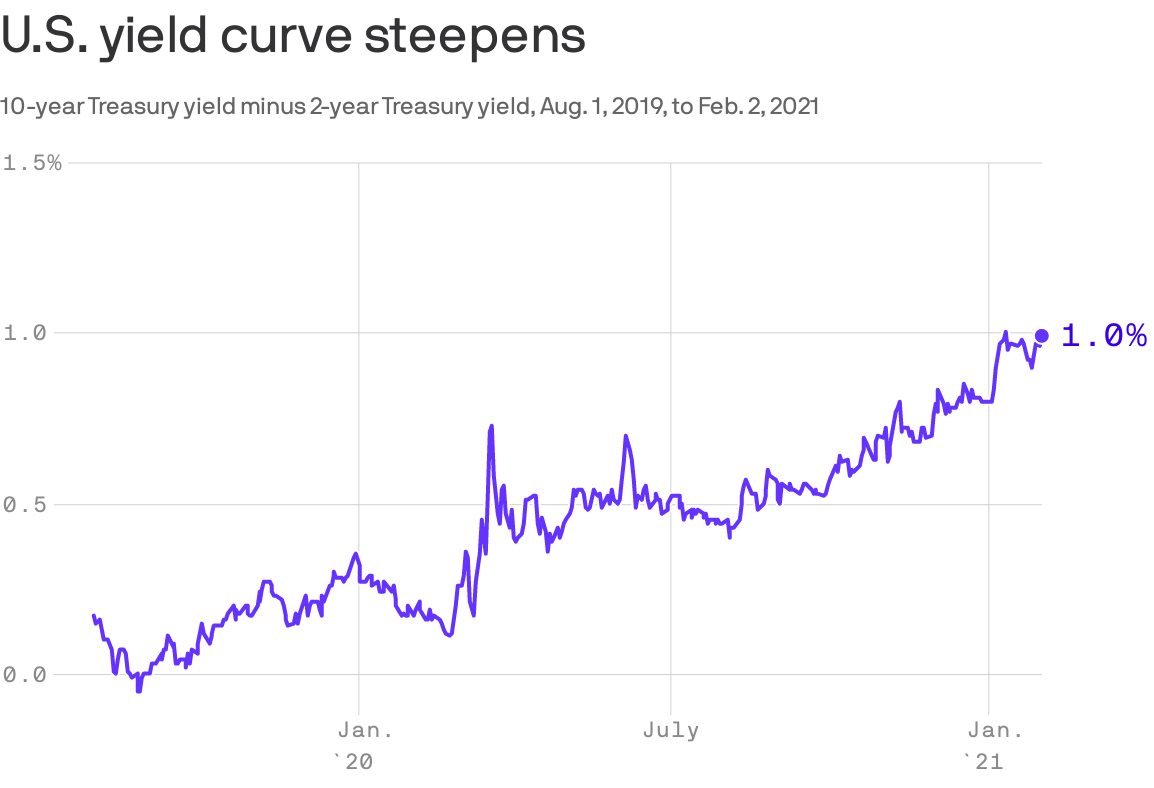

Yield Curve Relentlessly Steepens Posted on January 13, 21 January 12, 21 by Gary Tanashian Another week, another yield curve steepener and continuation of the trend that began in August 19During the tumultuous initial week of 21, the "US yield curve reached its steepest level in four years," reported Bloomberg News The ostensible cause was the buzz that the unifiedFor the time being, we need to guide yield curve control with this point in mind," Amamiya said Amamiya also said the BOJ will seek ways to enhance interest rate cuts as a monetary easing tool "Some market players think the BOJ can't and won't ease policy further due to the sideeffects of its policy

Yield Curve Control What It Is And Implications Daytrading Com

Inverted yield curve 2021

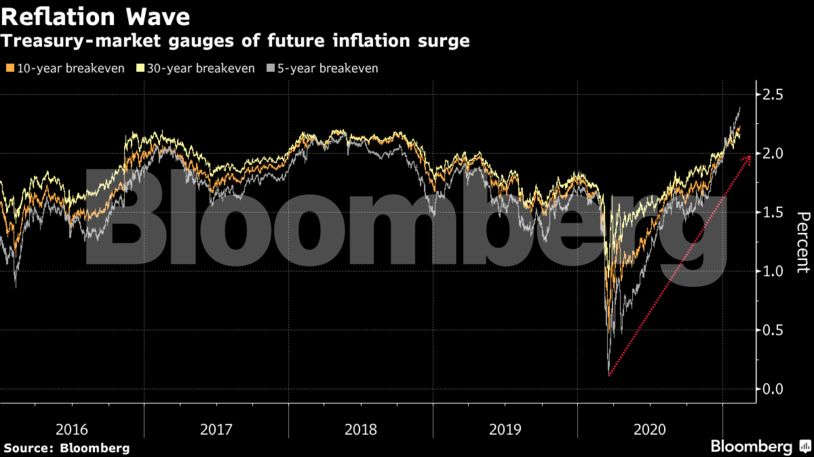

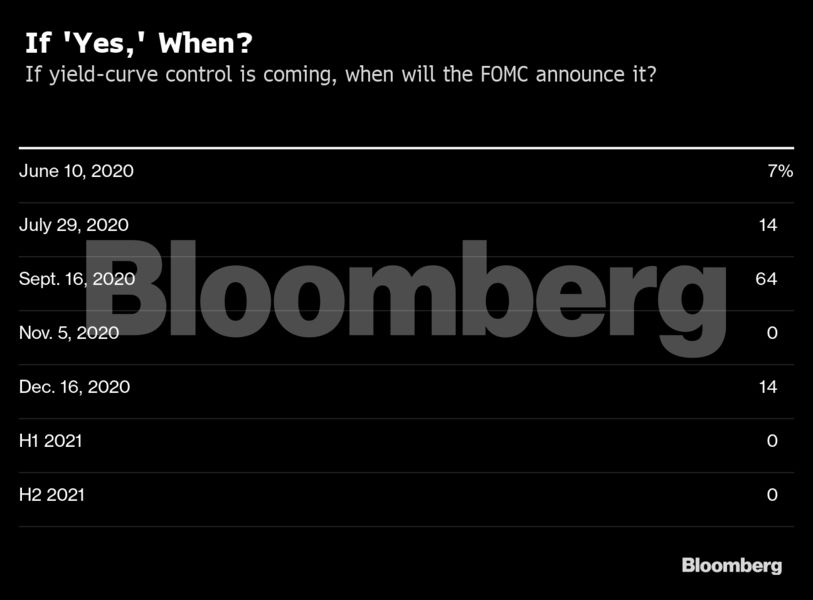

Inverted yield curve 2021-Yield curve pioneer Campbell Harvey says inflation is a growing threat February 25, 21 Several prominent economists think inflation is a growing concern for the US economyYield Curve Control Option 2 FrontEnd Pin A second way to do yield curve control is to primarily focus on the short end of the curve The Fed is willing and able to lock shortterm interest rates wherever they want, but they would find it more onerous to outright control the long end of the Treasury curve

Ecb Is Capping Bond Yields But Don T Call It Yield Curve Control Bnn Bloomberg

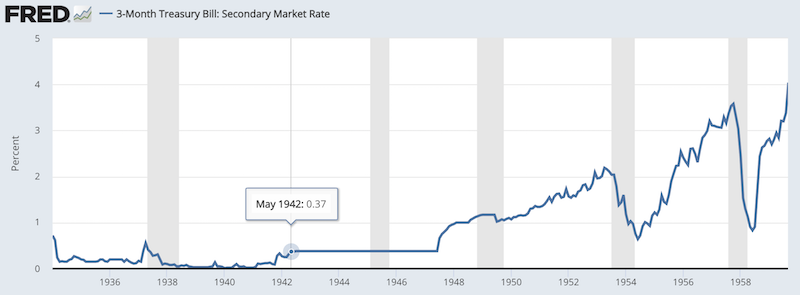

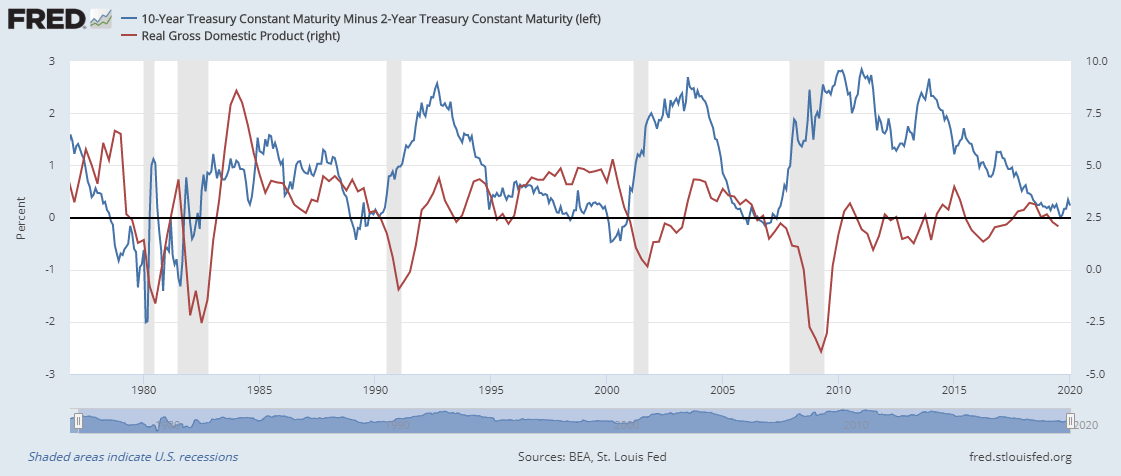

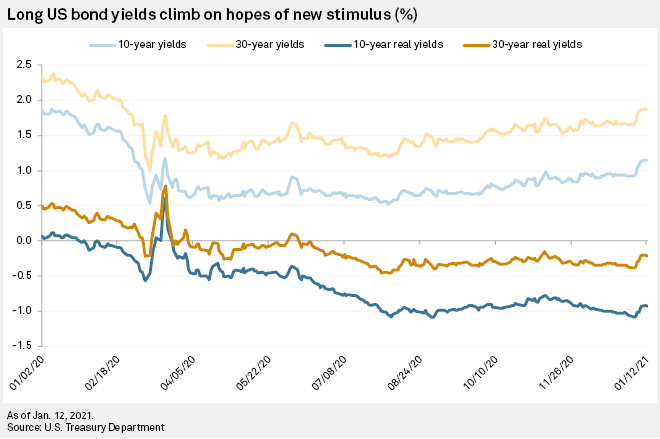

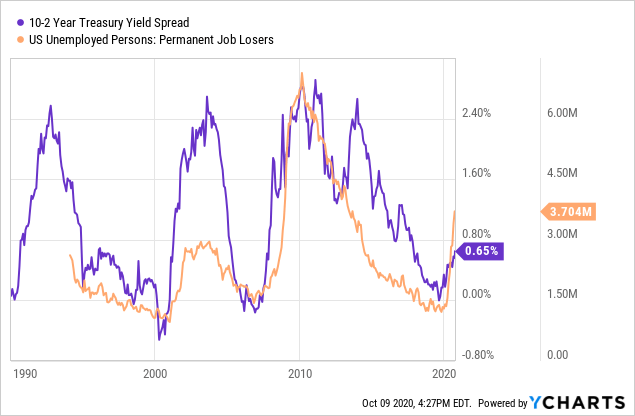

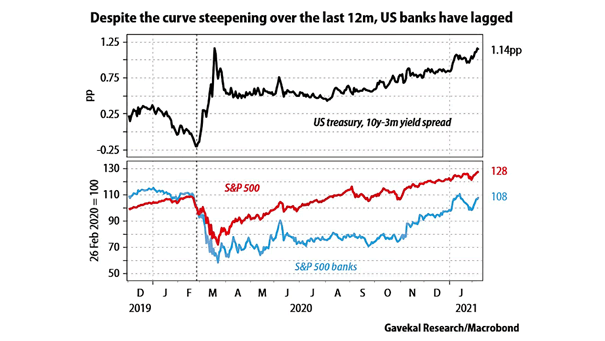

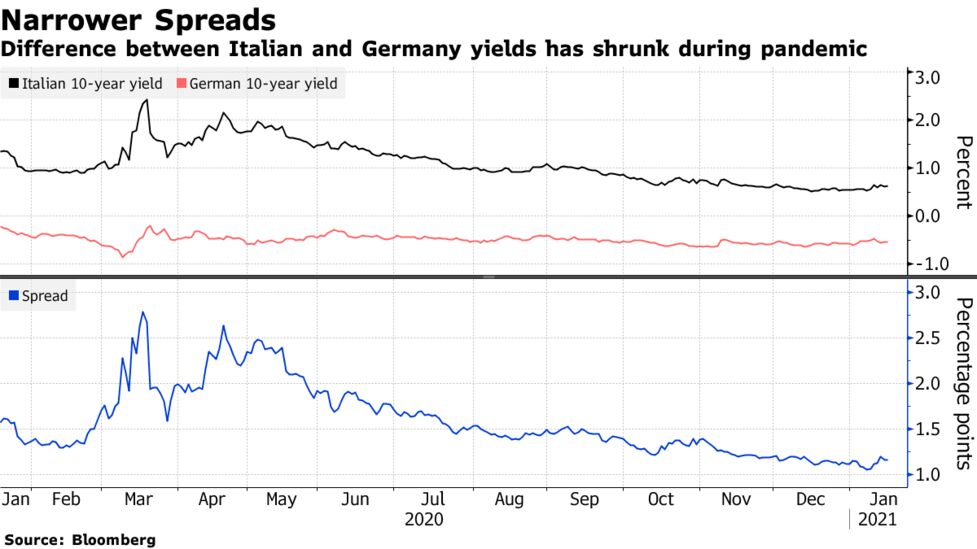

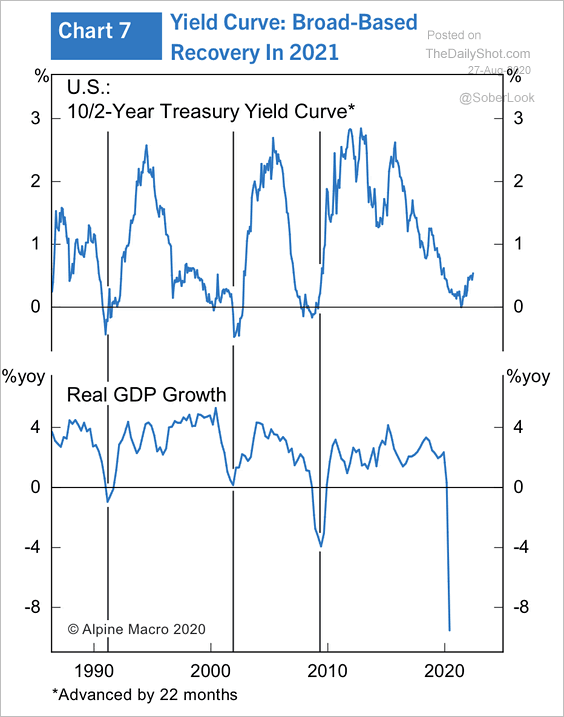

The steepness of the yield curve is a decent indicator of future financial market liquidity It is tough to depict all of the different bond yields along the entire maturity spectrum, so I am simulating that yield curve steepness by looking at the spread between 10year TNote yields and 3month TBill yieldsIn our 21 outlook report titled 'A Shot at Recovery', we noted that our overall outlook for the yield environment in 21 was biased towards an upward reversal from the historically low levels ofThe European Central Bank does not conduct explicit YCC but is tying its stimulus more heavily to the yield curve ECB board member Fabio Panetta said on Tuesday the recent steepening in the yield

Yield curve pioneer Campbell Harvey says inflation is a growing threat February 25, 21 Several prominent economists think inflation is a growing concern for the US economyThe timing rules for this model are based on the state of yield curve and on the trend of the Effective Federal Funds Rate and signal switches from stocks to gold, and vice versa, near or during recession periods Performance for the period Jan00 to Jan21 is shown in Figure1 The annualized return would have been 224% with a maximumThe European Central Bank does not conduct explicit YCC but is tying its stimulus more heavily to the yield curve ECB board member Fabio Panetta said on Tuesday the recent steepening in the yield

Should you fear the rising yield curve?Yield Curve Steepening, and Small Caps McClellan Financial Publications, Inc Posted Mar 3, 21 Feb 26, 21 Liquidity is bullish for the stock market It is even more bullish for small cap stocks and other types of issues which are more sensitive to liquidityBond Report 30year Treasury yield hits highest levels in a year on recovery hopes Last Updated Feb 3, 21 at 346 pm ET First Published Feb 3, 21 at 812 am ET

Inverted Yield Curve Suggesting Recession Around The Corner

21 Fixed Income Outlook Calmer Waters Charles Schwab

March 2, 21, 852 AM EST Updated on March 2, 21, 946 AM EST "We are already seeing undesirable contagion from rising US yields into the euro area yield curve," Panetta said "IfTom Lydon March 1, 21 The yield curve elevates when interest rates on longerterm bonds are higher than those on the shorter term bonds and, as a result, the spread between them broadensRead more RBC says to buy these 15 stocks as small companies keep dominating the market and details why each is a top pick for 21 A steepening yield curve typically indicates a strengthening

What The Yield Curve Is Actually Telling Investors Seeking Alpha

Goldman Goes All In For Steeper U S Yield Curves As 21 Theme Bloomberg

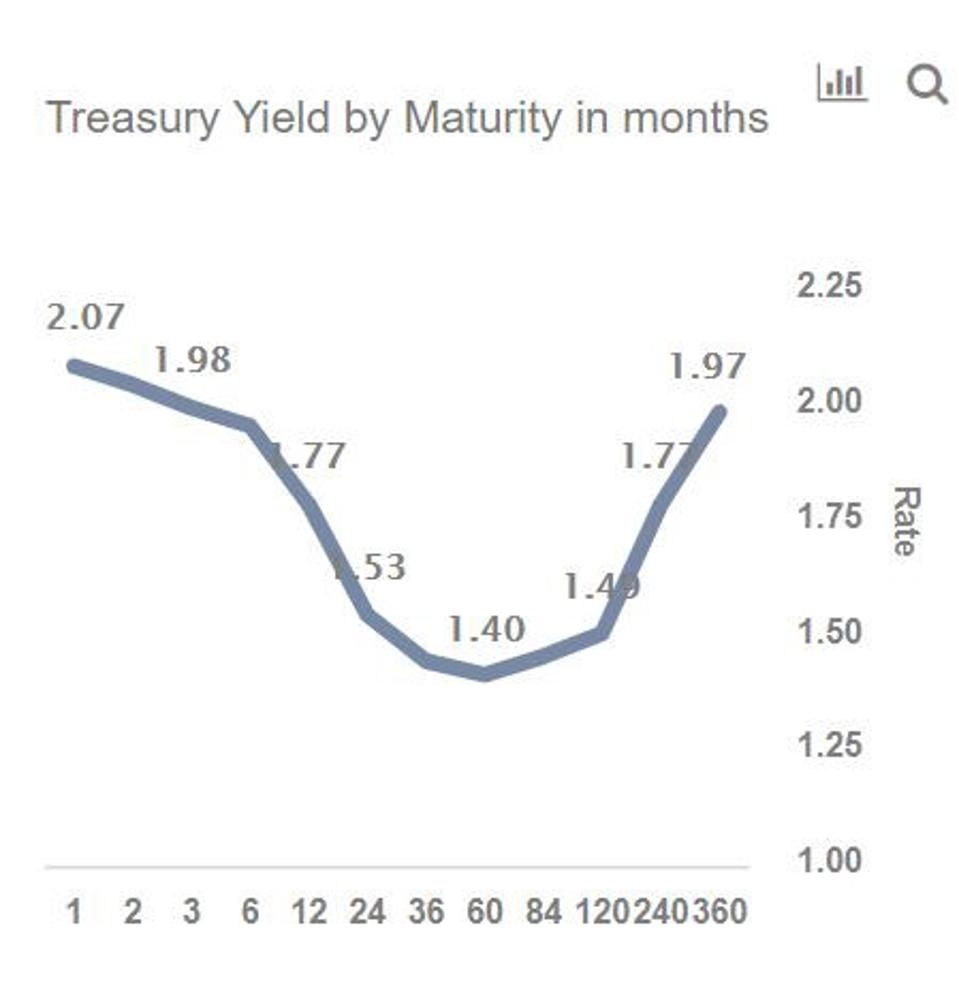

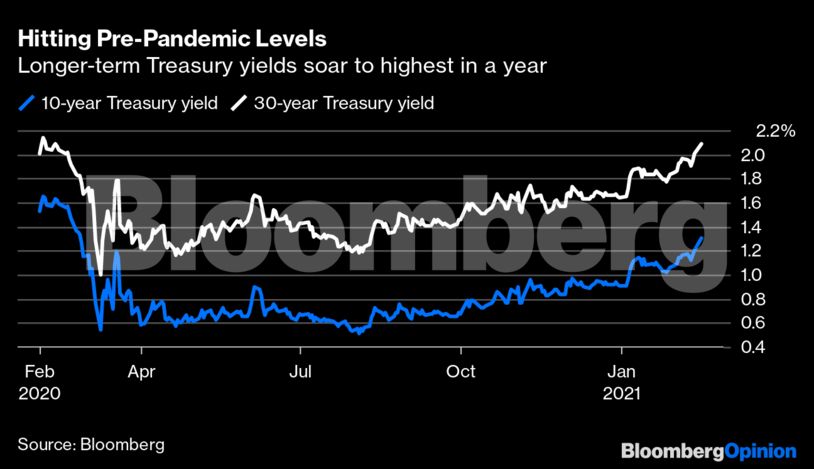

The yield on the oneyear Treasury is slightly below where it was on February 1 The yield on the two year is exactly where it was on that day The 10 year, however, has moved up from 109 percent to 134 percent and the 30 year has gone from 184 percent to 214 percent Bond yields move in the opposite direction of pricesGraph and download economic data for from to about 2year, yield curve, spread, 10year, maturity, Treasury, interest rate, interest, rate, and USAHSBC's Frederic Neumann says the reasons for the steepening US yield curve are different now compared to the "taper tantrum" of 13, adding it has yet to reach levels that could trigger

What The Yield Curve Is Actually Telling Investors Seeking Alpha

Ecb Is Capping Bond Yields But Don T Call It Yield Curve Control Bnn Bloomberg

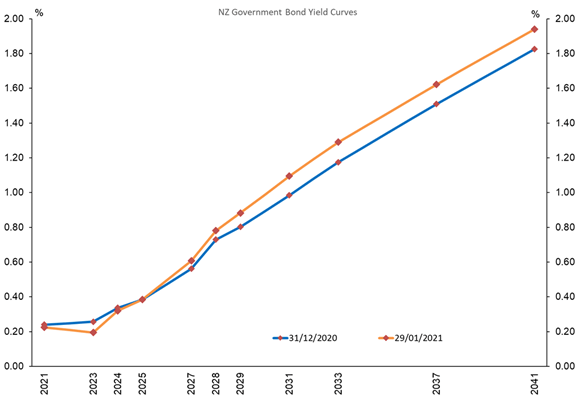

The bond market is keeping a close eye on the yield curve between the 2year and 10year Treasury Skip Navigation The average forecast of economists for 21 growth is 5% in the Moody'sThe January 21 inflation rate of 02% suggest that the rate of deflation is reversing, having recovered from last year's devastating reading of 12% The steepening of the yield curve10year Treasury yield jumps to 21high of 162% before pulling back Published Fri, Mar 5 21 349 AM EST Updated Fri, Mar 5 21 419 PM EST Maggie Fitzgerald @mkmfitzgerald

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

Current Market Valuation

The European Central Bank does not conduct explicit YCC but is tying its stimulus more heavily to the yield curve ECB board member Fabio Panetta said on Tuesday the recent steepening in the yieldYieldcurve steepening shows up 15 months later as smallcap outperformance Plus, investmentnewsletter commentary on consumer spending, the end of the ReaganVolcker era, and bank M&AThe yield on the oneyear Treasury is slightly below where it was on February 1 The yield on the two year is exactly where it was on that day The 10 year, however, has moved up from 109 percent to 134 percent and the 30 year has gone from 184 percent to 214 percent Bond yields move in the opposite direction of prices

Should Investors Be Concerned About Yield Curve Inversion Marquette Associates

/inverted-yield-curve-56a9a7545f9b58b7d0fdb37e.jpg)

Inverted Yield Curve Definition Predicts A Recession

A flat yield curve, or the even more ominous inverted yield curve, is seen as an omen of upcoming economic distress A widening yield curve, as we are seeing now, is considered a good omen for the economy Certainly, talk in Congress of another $19 trillion in stimulus spending is having an effect on the longer yieldsFeb 4, 21 115 pm ET Order Reprints The steepness (or flatness) of the yield curve—the change in yields across different Treasury maturities—is seen as an indicator of economic growthAlso, the yield on the 30year Treasury bond climbed 166 bps over the same time frame to 230% Thus, the steepening yield curve is expected to benefit major banks' net interest margins amid a

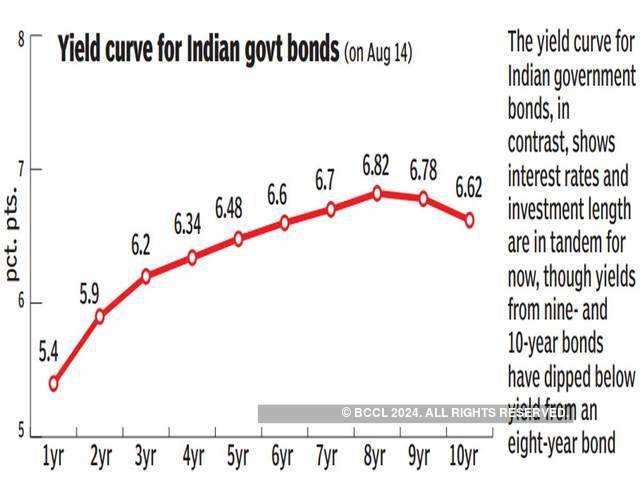

How Bond Yields Might Tell Us If World Is Headed For Recession What S An Inverted Yield Curve The Economic Times

Fed Efforts To Stem Rises In Yields Back On The Table In 21 Variant Perception

Asks Rocky White, senior quantitative analyst with Schaeffer Investment Research, an industry leading provider of market timing and options investing and trading advice The 10year Treasury yield fell below 1% in the early stages of the Covid19 pandemic As you've probably heard, its back above that level now and rising fastUpdated February 08, 21 An inverted yield curve is when the yields on bonds with a shorter duration are higher than the yields on bonds that have a longer duration It's an abnormal situation that often signals an impending recession In a normal yield curve, the shortterm bills yield less than the longterm bondsYield Curve Relentlessly Steepens Posted on January 13, 21 January 12, 21 by Gary Tanashian Another week, another yield curve steepener and continuation of the trend that began in August 19

Us Debt And Yield Curve Spread Between 2 Year And 10 Year Us Bonds The Market Oracle

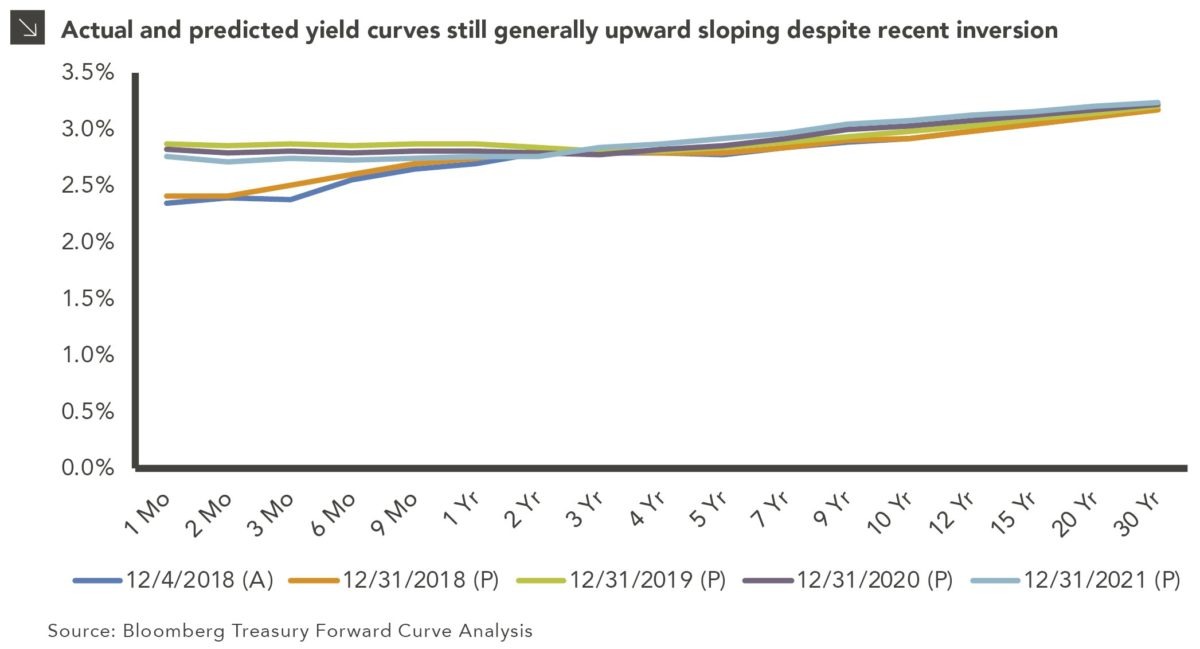

Steepening Yield Curves In March Looking Beyond The Covid 19 Crisis Ftse Russell

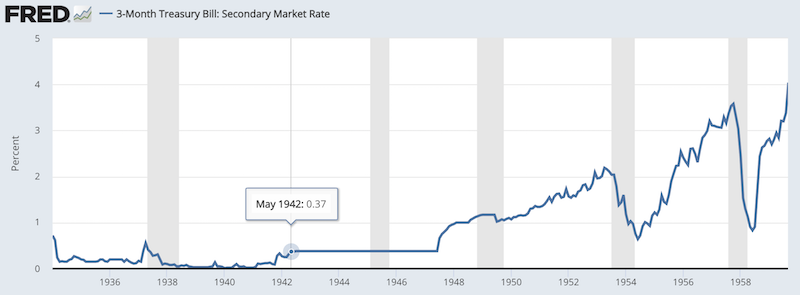

Surging Inflation May Force Fed to Resort to Yield CurveControl By Liz McCormick, February 9, 21, 1103 AM EST For 21, headline CPI will have to be at least 3% for the Fed to considerLast Update 9 Mar 21 515 GMT0 The United States 10Y Government Bond has a 1570% yield 10 Years vs 2 Years bond spread is 1405 bp Normal Convexity in LongTerm vs ShortTerm Maturities Central Bank Rate is 025% (last modification in March ) The United States credit rating is AA, according to Standard & Poor's agency Current 5Years Credit Default Swap quotation is 1010Yield curve in the US 21 Published by Statista Research Department, Mar 1, 21 In the end of January 21, the yield for a twoyear US Treasury bond was 014 percent, slightly above the one

Yield Curve Don T Lie Industry News Pensford

10 Year Treasury Constant Maturity Minus 2 Year Treasury Constant Maturity T10y2y Fred St Louis Fed

10year Treasury yield jumps to 21high of 162% before pulling back Published Fri, Mar 5 21 349 AM EST Updated Fri, Mar 5 21 419 PM EST Maggie Fitzgerald @mkmfitzgeraldSaturday Mar 6, 21, 315 PM Treasury Real Yield Curve Rates These rates are commonly referred to as "Real Constant Maturity Treasury" rates, or RCMTs Real yields on Treasury Inflation Protected Securities (TIPS) at "constant maturity" are interpolated by the US Treasury from Treasury's daily real yield curveThe January 21 inflation rate of 02% suggest that the rate of deflation is reversing, having recovered from last year's devastating reading of 12% The steepening of the yield curve

December Yield Curve Seeking Alpha

The Rise Of The Yield Curve Manulife Investment Management

Yahoo Finance's Brian Cheung joins the Yahoo Finance Live panel with today's Yahoo U Yield Curve Control The Nifty 50 gauge has jumped almost 9% in 21, more than triple the advance in theYieldcurve control, or YCC, he says The latest reading of consumer prices to be released Wednesday is supposed to show a still tepid pace of inflation, and the Fed's preferred measure holdsDuring the tumultuous initial week of 21, the "US yield curve reached its steepest level in four years," reported Bloomberg News The ostensible cause was the buzz that the unified

As Talk Of A Recession Gets Louder Globally Bond Yields Curve Have Featured In News Reports Both Globally And Within India In Recent Months As It Most Accurately Reflects What Investors Think

Ecb Is Capping Bond Yields But Don T Call It Yield Curve Control

By Leika Kihara TOKYO (Reuters) Bank of Japan Deputy Governor Masayoshi Amamiya said on Monday the central bank must focus on keeping the entire yield curve "stably low" for the time being, as the economy continues to suffer from the coronavirus pandemicA steep yield curve — when there is a large spread in interest rates between shorterterm Treasury bonds to longerterm bonds — often precedes a period of economic expansion, as investors bet that a central bank will be forced to raise rates in the future to tamp down higher inflation The opposite is true of inverted yield curves, whichUSD/bbl 072 121% In its vision for key global 21 investment themes, Goldman Sachs Group Inc sees the US yield curve steepening for nominal as well as real rates The forecast, laid out

Irrational Exuberance Blackfort

The First Half Of 21 May Be A Turbulent Period For Stocks Sp500 Seeking Alpha

Tom Lydon March 1, 21 The yield curve elevates when interest rates on longerterm bonds are higher than those on the shorter term bonds and, as a result, the spread between them broadensBank of Japan Deputy Governor Masayoshi Amamiya said on Monday the central bank must focus on keeping the entire yield curve "stably low" for the time being, as the economy continues to suffer theYield curve pioneer Campbell Harvey says inflation is a growing threat February 25, 21 Several prominent economists think inflation is a growing concern for the US economy

U S Treasury Securities Yield Curve Mar Jan 21 Download Scientific Diagram

The Rise Of The Yield Curve Manulife Investment Management

The steepening of the yield curve came on the back of inflationary expectations The 10year US breakeven inflation rate, TIPS ETFs to Buy for 21 on Inflation Trade)We aim to publish the latest daily yield curves by noon on the following business day Archive yield curve data are available by close of business of the second working day of a month, for example, data for the 31/12/10 will be published by close of business 05/01/11 Latest yield curve data Yield curve terminology and conceptsZhikai Chen from BNP Paribas says rising rates in the US at the moment suggest more of an economic recovery expectations rather than inflation expectations

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Will 1 10 Year Treasury Yield Force The Fed Into Curve Control Bloomberg

The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, , and 30 years This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity

Bond Market Reflation Trade Absorbs Punch To Extend 21 Advance The Economic Times

The Yield Curve Is Steepening Here S What That Means For Markets Seeking Alpha

Yield Curve Inversion Is Sending A Message

Understanding Treasury Yield And Interest Rates

Yield Curve Economics Britannica

Into The Storm Us Treasury Yield Curve Slope Hits 127 As Bitcoin Hits 51 000 9 72x Since March 18 And Lumber Futures Rise 3x Since Same Date Confounded Interest Anthony B Sanders

The Yield Curve Continues To Steepen Notes From The Rabbit Hole

Q Tbn And9gcqppc Wozt1cmtp31rullg8hulnuho Jiblb6lx11hedbmsb72p Usqp Cau

Goldman Sachs S Big Bond Call Is Just Bluster Again

Yield Curve Relentlessly Steepens Ino Com Trader S Blog

Treasury Curve Trading Trends And Highlights Cme Group

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Yield Curve Control What It Is And Implications Daytrading Com

Goldman Goes All In For Steeper U S Yield Curves As 21 Theme

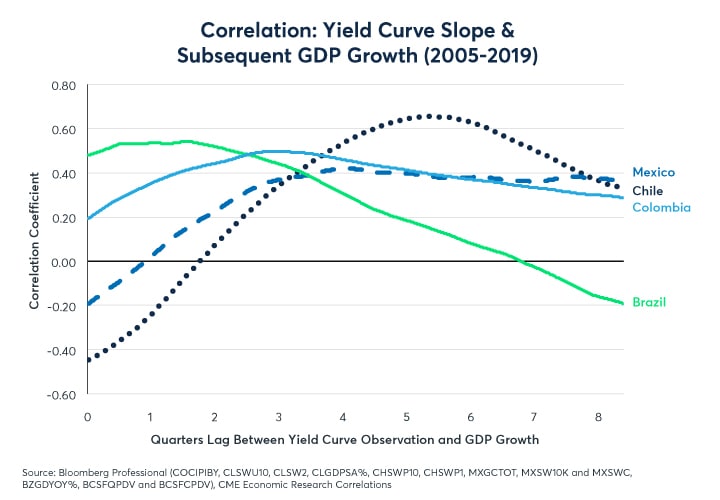

Yield Curve Slope Correlations Seeking Alpha

Sovereigns To Test The Long End Of The Curve Omfif

This Metric Suggests There S An Economic Boom Ahead And Possibly Inflation

The Turn In The Yield Curve Wsj

Should You Fear The Rising Yield Curve

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

Understanding Treasury Yield And Interest Rates

Fingfx Thomsonreuters Com Gfx Mkt 12 4686 4648

Currency Market Nzd Yield Curve And Vital Points

Search Results For 10y 3m Isabelnet

Us Bonds Fed S Yield Curve Control Isn T For Taming Long Bonds The Economic Times

Outlook 21 Allianz Global Investors

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

Singapore Savings Bonds Ssb February 21 Issue Short Term Interest Yield Going Up Investment Moats

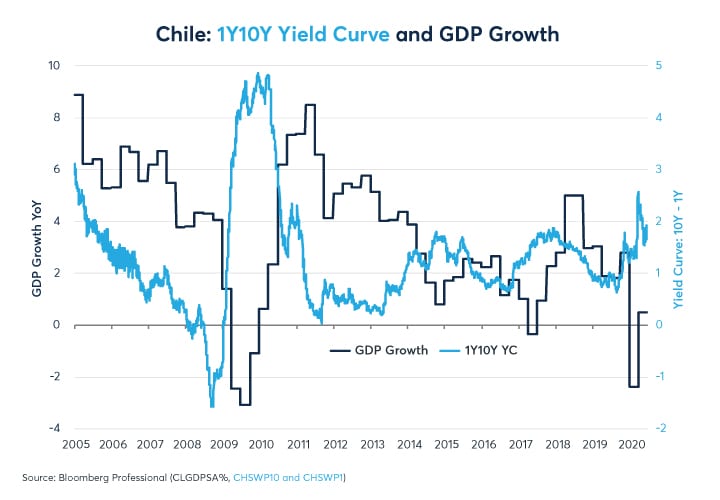

Chile On The Road To Recovery In 21 Cme Group

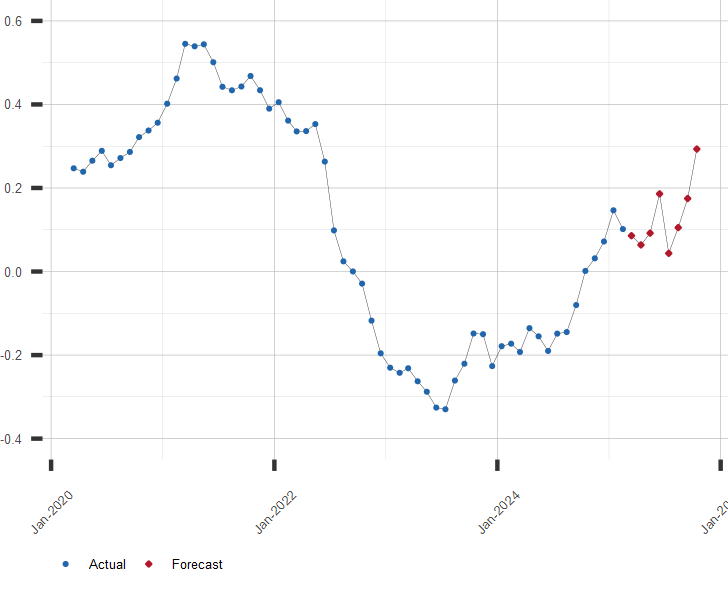

Forecast Of U S Treasury Yield Curve Slope

Why Are Yields On The Rise And How Could Higher Yields Affect Investors Rbc Wealth Management

Yield Curve Relentlessly Steepens Gold Builds A Handle Kitco News

1

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

V8kwijlxtng6tm

Fundstrat S Tom Lee Pinpoints The Single Most Important Indicator Signaling Strong Economic Growth And Details His Stock Market Strategy For Taking Advantage Markets Insider

Chile On The Road To Recovery In 21 Cme Group

This Metric Suggests There S An Economic Boom Ahead And Possibly Inflation

The Daily Yield Curve

The Rise Of The Yield Curve Manulife Investment Management

Search Results For Yield Curve Isabelnet

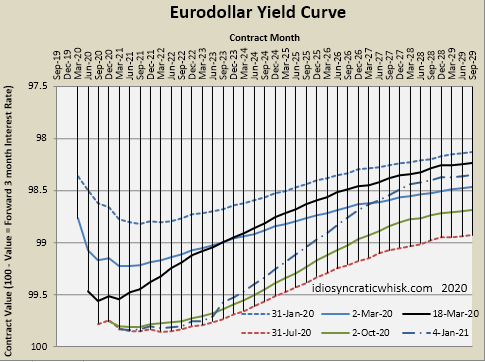

Idiosyncratic Whisk May Yield Curve Update

Q Tbn And9gcrupksdegiuv Fr9ual7 Ynu9ncm6mys9761nzoyuxjhdrcjojl Usqp Cau

What Might Be In Another Market Based Yield Curve Twist Snbchf Com

Ecb Is Capping Bond Yields But Don T Call It Yield Curve Control Bloomberg

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Understanding Treasury Yield And Interest Rates

How To Play A Steeper Yield Curve

Yield Curve Gurufocus Com

Long Bond Pain Resumes Steepening U S Treasury Yield Curve

Q Tbn And9gctocwybly4hbob2zs93ek Ay 7di6squnvbqjin4q9vuyr3pvpw Usqp Cau

The Rise Of The Yield Curve Manulife Investment Management

Us Bonds Fed S Yield Curve Control Isn T For Taming Long Bonds The Economic Times

Canadian Yield Curve Points To Slow Growth Not Recession Invesco Canada Blog

Fed To Stay The Course With Yield Curve Control Likely Ahead The Economic Times

Higher Yields And Commodity Prices Intensify Recessions Seeking Alpha

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

21 What Are The Prospects For Trading Markets Refinitiv Perspectives

Us Long Term Interest Rates Hit Highest In A Year On Stimulus Impact Financial Times

Yield Curve Pioneer Harvey Says Inflation Is A Growing Threat Quartz

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

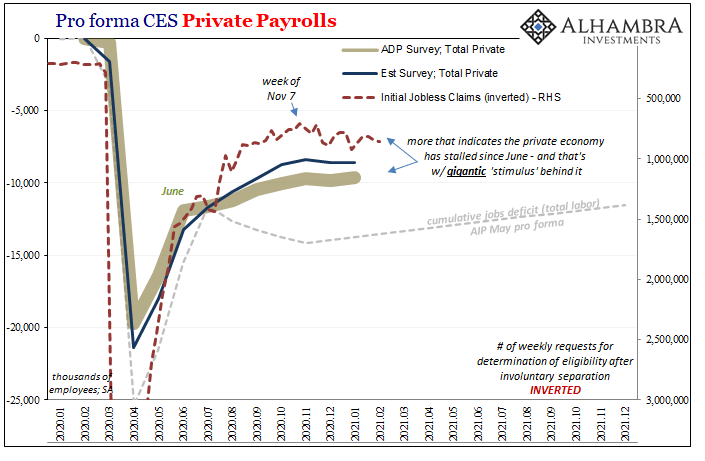

Us Recession Watch January 21 Slowing Growth Evident As Calendar Turns

Steeper U S Yield Curve Helps Usd But Has Not Yet Hurt Risk Demand Investing Com

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Decomposing Predicting The Euro Yield Curve By Bernhard Pfann Feb 21 Towards Data Science

Stocks Rise And Bond Yields March Higher As Investors Focus On Economic Recovery Instead Of Trump Turmoil And Covid Crisis Currency News Financial And Business News Markets Insider

What Is The Yield Curve Telling Investors Shares Magazine

Yield Curve Used In Fair Value Calculations Of Index Futures Indexarb Com

21 Fixed Income Outlook Calmer Waters Charles Schwab

The Bond Market Gets Optimistic Axios

Addressing A Flat Yield Curve Executive Benefits Network Executive Benefits Network

U S Yield Curve 21 Statista

Us Yield Curve Steepest Since 15 On Stimulus Hopes Financial Times

Key Yield Curve Inverts As 2 Year Yield Tops 10 Year

History Shows Asian Currencies Can Weather Steeper Yield Curve Bloomberg

19 S Yield Curve Inversion Means A Recession Could Hit In

Yield Curve And U S Real Gdp Growth Broad Based Recovery In 21 Isabelnet

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

コメント

コメントを投稿